- Breadth momentum extends traditional absolute momentum approaches for crash protection.

- Breadth momentum quantifies risk at the universe level by the number of assets with non-positive momentum relative to a breadth protection threshold.

- Vigilant Asset Allocation matches breadth momentum with a responsive momentum filter for targeting offensive annual returns with defensive crash protection.

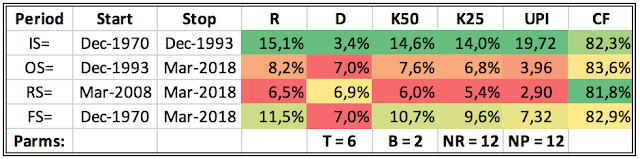

Vigilant Asset Allocation (VAA) is a dual-momentum based investment strategy with a vigorous crash protection and a fast momentum filter. Dual momentum combines absolute (trend following) and relative (cross-sectional) momentum. Contrary to the traditional dual momentum approaches with crash protection through trend following on the asset level, in VAA risk is quantified at the universe level. For superior protection the VAA cash fraction equals the number of assets with non-positive momentum relative to a breadth protection threshold. The combination of breadth momentum with a responsive filter for measuring dual momentum results in a granular crash indicator that allows for targeting offensive annual returns while offering defensive tail risk protection. The VAA methodology is comprehensively explained in our paper published on SSRN.

The VAA recipe

- Given a top selection T and a breadth protection threshold B, for each month:

- Compute 13612W momentum for each asset

- Pick the best performing assets in the “risk-on” universe as top T

- Pick the best asset in the “risk-off” universe as safety asset for “cash”

- Compute the number of assets with non-positive momentum in the “risk-on” universe (b)

- Compute b/B and round down to multiples of 1/T as “cash fraction” CF for “easy trading”

- Replace CF of top T by “cash” asset as selected in step 3

13612W momentum filter

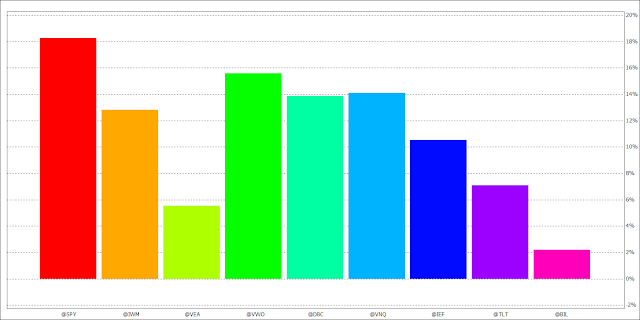

In the dual momentum frame work cross-sectional or relative strength momentum is applied for picking the best performing assets for top selection while absolute momentum is utilized to establish whether or not an asset is an uptrend or downtrend (trend following). Different momentum filters are in vogue, like Antonacci’s 12-month return (RET12) for GEM, Keller’s price relative to its 12-month simple moving average (SMA12) for PAA, or Faber’s averaged momentum over the past 1, 3, 6, and 12 months (13612) for GTAA. For VAA we developed a new momentum filter: a variant of the 13612 filter, but now with an even faster response curve by using the average annualized returns over the past 1, 3, 6, and 12 months (13612W). Our 13612W filter has the following composition:

13612W = ( 12 * p0/p1 + 4 * p0/p3 + 2 * p0/p6 + p0/p12 ) / 19 - 1, where pt equals price p with lag tThis results in monthly return weights for p0/p1, p1/p2, …, p11/p12 of 19, 7, 7, 3, 3, 3, 1, 1, 1, 1, 1, 1, respectively. Notice that our responsive 13612W filter gives a weight of 40% (19/48) to the return over the most recent month as compared to 8% (RET12), 15% (SMA12), and 18% (13612). The following graphic crystallizes the various weighting schemes for the mentioned momentum filters.

Within the VAA frame work our 13612W filter is applied for both relative and absolute momentum.

Quantifying breadth momentum for defensive crash protection

Expanding on the crash protection routine laid down in our PAA-paper, our breadth protection threshold (B) adds granularity and allows for swift allocation adjustments when trend changes occur. Like for PAA, assets are tested on absolute momentum, but now using the responsive 13612W filter, resulting in a number of assets with positive and non-positive momentum respectively (the so-called “bad” and “good” assets). Thus, absolute momentum is applied for establishing a universe’s breadth momentum. Next, our new breadth protection threshold B is defined as the minimum number of “bad” assets (b) for which the strategy is 100% invested in a “risk-off” asset (“cash”). For an N-sized “risk-on” universe, a portfolio’s cash fraction (CF) is determined by the ratio b/B. In formula:

CF=b/B with 0<=CF<=1 limits, where b=0,1,..,N and B<=N.For more explanation please refer to our paper, or post a question in the comment section.

Easy trading

In the traditional dual momentum approaches (only) top assets are tested on absolute momentum and as a result, the top asset fractions equal the cash fractions. Hence every top asset is replaced by an equal share of cash in case it fails to pass absolute momentum testing. This results in “easy trading” with capital sizes of 1/T: every “bad” asset is simply replaced by “cash”.

Like with PAA, the universe based breadth approach for cash protection is prone to awkward capital sizes which leads to more trading for rebalancing open or initiating new positions. To facilitate “easy trading” (ET) for VAA too, the fractions b/B need to be mapped to a multiple of the top asset fractions 1/T, and the corresponding worst asset(s) from the top T are to be replaced by the found cash fraction CF (the worst assets are those with the lowest 13612W momentum in the top T). Rounding down the raw fractions b/B to multiples of 1/T renders the desired result. In general, the formula for CF with ET through rounding becomes:

CF=(1/T) * floor(b*T/B) with 0<=CF<=1 limits

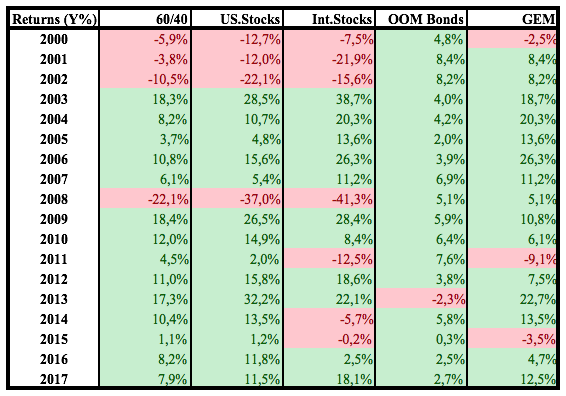

VAA-G4 with T=1/B=1 & Top=2/B=1 compared to GEM

Focusing on concentrated portfolios, the Global 4 (G4) universe from our VAA-paper universes is inspired by Antonacci’s GEM (see post). The ETFs for GEM are VOO (US-stocks) or VEU (global market stocks ex US) and BND (US aggregate bonds) as safety net. To accommodate for sufficient breadth VEU is separated into VEA (developed international market stocks) and VWO (emerging market stocks). Furthermore, BND is added, which leads to an excess return approximation: to be eligible for capital allocation, the stock ETFs have to outperform BND. The “cash” universe is populated with SHY (US short-term treasuries), IEF (US mid-term treasuries), and LQD (US investment grade corporate bonds) to prospect “crisis alpha”.

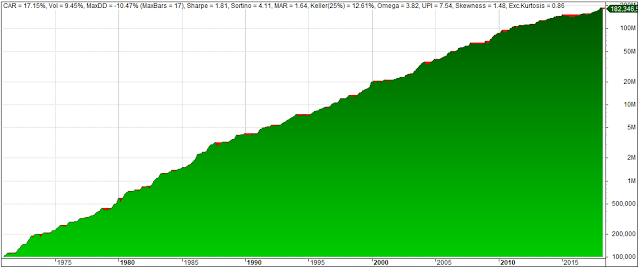

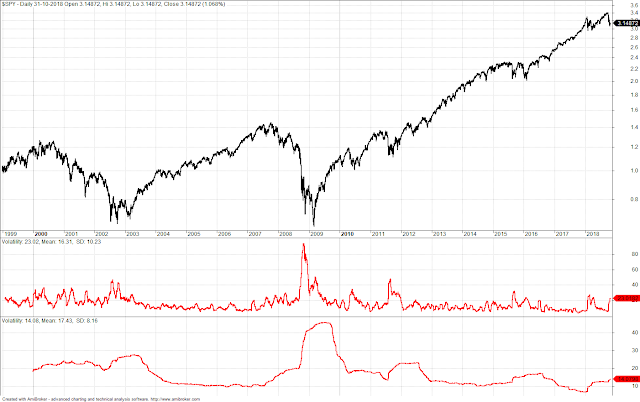

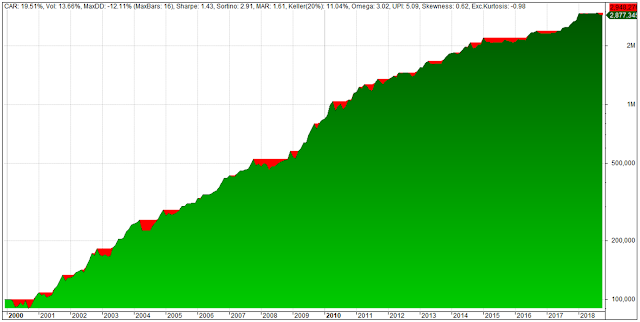

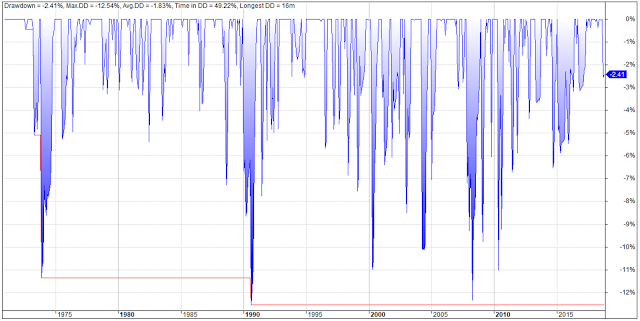

The chart below compares the equity curves and drawdown profiles for two VAA-G4 strategies against GEM over the backtested period: Dec. 1970 – June 2017. VAA-G4 in blue with T=1/B=1 and T=2/B=1 in black. GEM is depicted in red.

NB! Results are derived from simulated monthly total return data based on indices corrected for tracking errors. Furthermore, trading costs, slippage, and taxes are disregarded. Results are therefore purely hypothetical.As the above table with the key performance indicators illustrates, both VAA-G4 strategies clearly show outperformance over GEM, not only on “raw” returns, but especially in risk-adjusted terms. Notice the considerable lower drawdowns D and high win-rates for VAA-G4.

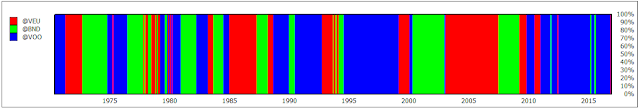

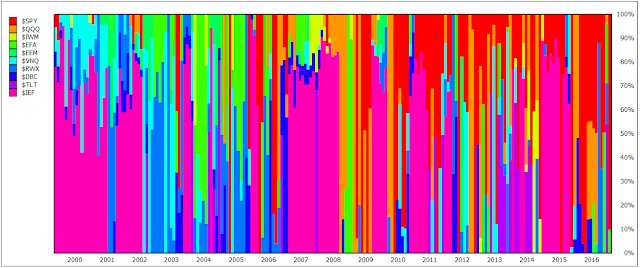

To be fair, the flip-side of VAA-G4’s outperformance (and its responsive 13612W momentum filter) is substantial asset re-allocation as is shown in the following diagrams with VAA-G4 with T=1/B=1 on the upper chart and GEM on the lower one.

Charts for VAA-G4 with T=2/B=1

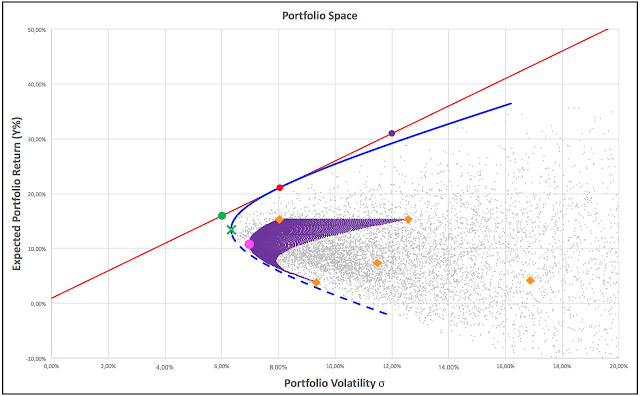

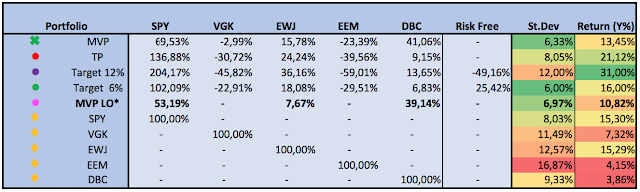

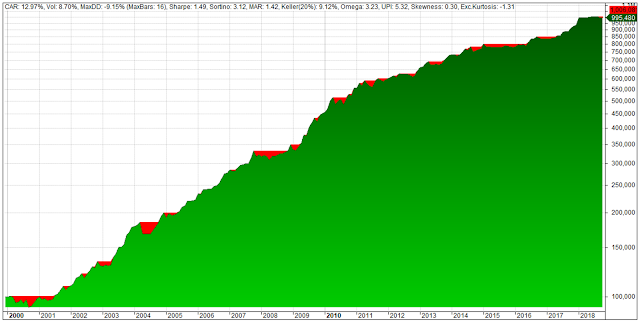

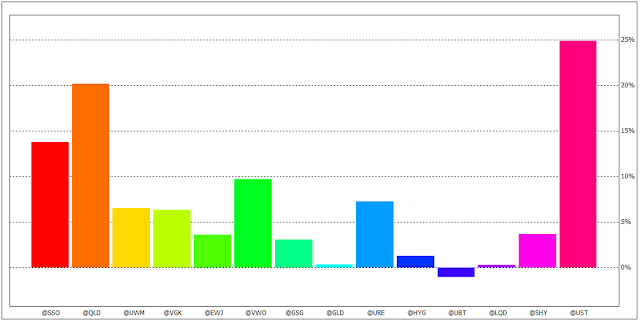

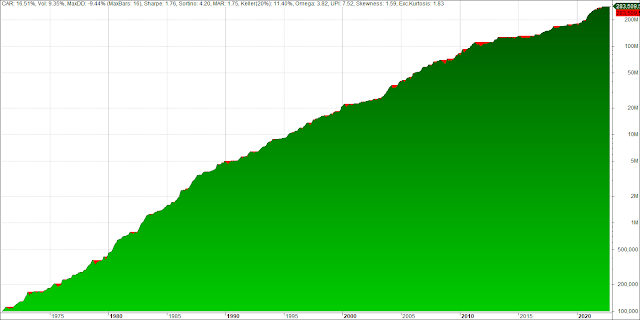

The following charts provide a detailed view on VAA-G4’s performance with T=2/B=1, being the strategy with the best risk-adjusted performance (see also VAA-paper, note 15).

To summarize: with T=2/B=1, capital is allocated 50:50 into the best two assets out of VOO, VEA, VWO, or BND, provided none of these four assets register non-positive 13612W momentum. However, if any single asset out of these four assets becomes “bad”, all capital is re-allocated to the best asset in the “cash” universe: SHY, IEF, or LQD.

Equity chart with key performance indicators:

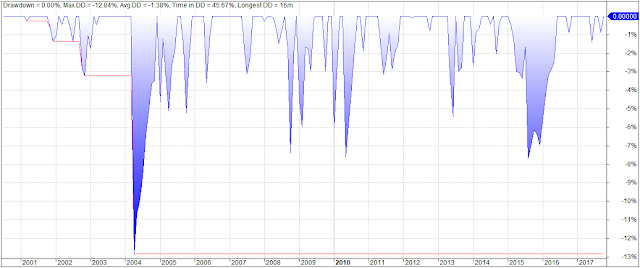

Drawdown chart:

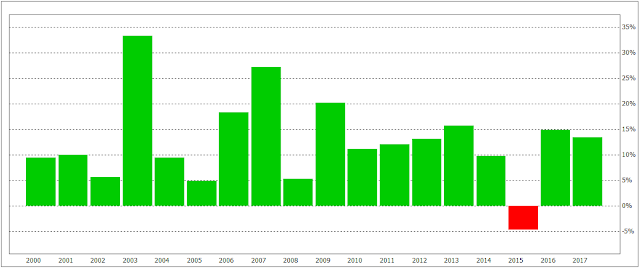

Annual returns:

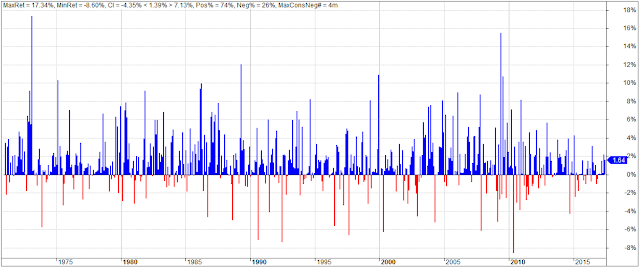

Monthly returns:

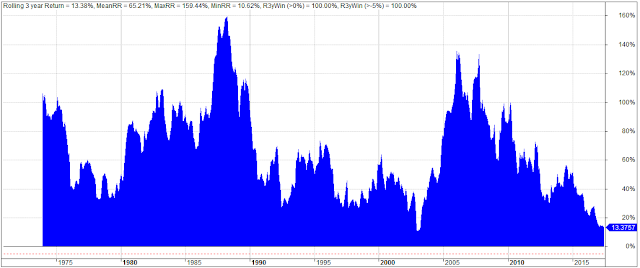

Rolling 3-year returns:

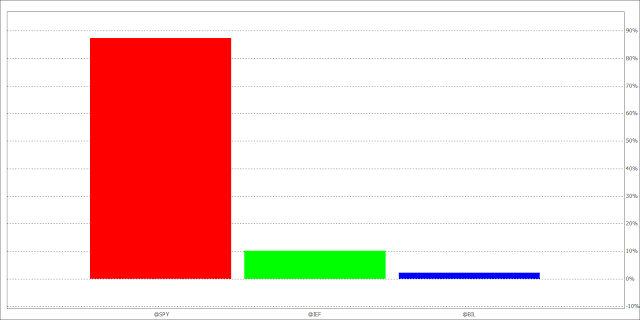

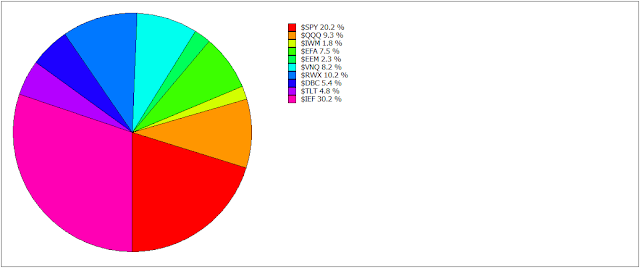

Allocation pie chart:

Profit contribution:

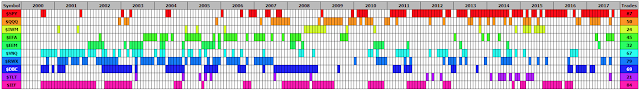

Allocation diagram:

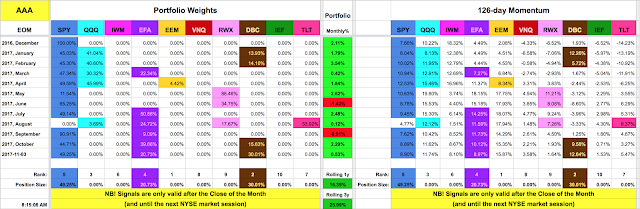

Signal table

[Coming soon]

End notes

- The mentioned GEM, PAA, and GTAA strategies are "real time" monitored by AllocateSmartly.

- The full charts suite for VAA-G4 with T/B=1/1 is available for download (zooming required).

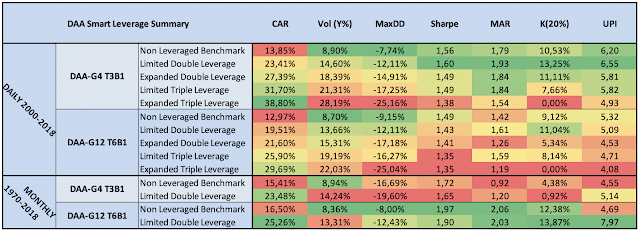

- Investors seeking more diversification might consider VAA-G12 with settings of T=2/B=4, T=3/B=4, T=4/B=4, or T=5/B=5 (see charts suites, zooming required).

The full AmiBroker code for VAA is available upon request. Interested parties are encouraged to support this blog with a donation.

.png)

.png)