Protective Asset Allocation (PAA) is a new provident long only tactical investment strategy that combines a dual momentum approach with a vigorous capital preservation routine. The key elements of PAA are:

- dual momentum based timing and selection mechanism

- innovative c(r)ash protection routine through protective momentum

- support for separate “risk-on” and “risk-off" universes

Each of these building blocks will be explained quite comprehensively followed by a detailed comparative backtest covering 45 years (Dec. 1970 – Dec. 2015). But first be ready for a truckload of conceptual particularities ;-)

In our quest for a yield neutral

absolute return performance strategy Wouter Keller and I developed PAA (long only) with its innovative protective momentum approach for capital preservation in times of market turmoil. The interested reader might consider reading our

PAA-paper on SSRN too.

PAA exploits the well-defined momentum phenomenon: the empirically observed tendency for asset prices to keep moving in the same direction. By applying PAA to a broad diversified global universe of sufficiently uncorrelated ETFs, PAA will auto-detect bull trends that emerge. Meanwhile protective momentum keeps guard over global market-breadth to adjust the “equity” : “cash” spread of the portfolio. And when trends shift, PAA catches the change and adapts, be it bullish or bearish. In doing so PAA is purely mechanical, so there is no need second guessing market conditions nor predicting trends. PAA is capable of delivering

absolute return performance with 1-year-rolling-return win rates of more than 95% (R1yWin>0%) and 99% (R1yWin>-5%).

![]() |

| Equity chart of the PAA strategy demonstrating high return/risk performance |

PAA setup and recipeBefore clarifying the model’s principle ingredients, PAA is defined by the following mechanics:

- populate a diversified global “risk-on” equity universe with preferably 10 or more ETFs for harvesting risk premia

- populate another universe consisting of “risk-off” treasury ETFs suitable as safe harbor for weathering market turmoil

- sort both ETF universes on their peer performance (relative momentum)

- assign capital proportional to the number of “risky” ETFs with non-positive momentum to the (best) safe harbor treasury ETF

- assign remaining capital equally to the “risky” ETFs with positive momentum in the top selection

- apply monthly portfolio reforms

SMA based filtering and selectionFor weeding out downtrending assets an SMA based absolute momentum filter is applied while concurrently assets are scored by the very same SMA based momentum metric for selecting the top performers for capital allocation. So absolute and relative momentum are derived from one and the same momentum metric:

MOM(L) = - 1

For staying close to the customary vocabulary by expressing momentum as a function of time, eg. Antonacci’s 12 month momentum model (p0/p12-1), an extra price point needs to be added to the SMA formula to comprise the same return collection. Hence for MOM(12) the data range of the SMA becomes 12+1 which covers a full year of monthly return data, just like the 12 month rate of change approach.

Point to note: in our formula the notation between SMA(L) and RET(L) with lookback (L) is harmonized, to such extend that i.e. SMA10 = SMA(9). Notice also risk-free return is not accounted for with regard to timing and selection.

Protective MomentumThe rationale behind PAA’s capital preservation routine is the global contagion effect of market crises. When turmoil hits the equities markets, risky assets tend to become highly correlated and start tanking in tandem. PAA assesses the risk of a market crisis by measuring multi-market breadth: the relative number of downtrending risky assets (MOM(L) ≤ 0). The more assets in distress, the higher the capital fraction that seeks shelter in a “safety asset”: a short- or mid-term treasury ETF. For this assessment PAA has three protection levels: low, medium and high. These c(r)ash protection levels are controlled through a “protection factor” (pf), which is an adjustable parameter in our Bond Fraction (BF) formula for an N-size “risk-on” universe:

BF =, with 0% ≤ BF% ≤ 100%

At low protection level the protection factor pf is set at 0. The full “risk-on” universe is monitored for non-positive momentum. For each and every risky asset with non-positive momentum, an equal part (1/N) is allocated to the “safe” treasury fund, which allocation equals the fraction of assets with non-positive momentum relative to the full size of the “risk-on” universe (with pf=0, the denominator of the BF formula reads: N). The capital fraction for the “safe” treasury fund reaches 100% when none of the risky assets has positive momentum.

With the protection level set to medium the protection factor is increased to 1: like before, all risky assets are under scrutiny, but full capital allocation to the safe haven is reached earlier: the “safe” treasury allocation equals the fraction of assets with non-positive momentum relative to three-quarters of the universe size (with pf=1, the denominator of the BF formula reads:

¾N). Put differently, in case the number of risky assets with positive momentum becomes 25% or less, total capital goes to the “safety asset”.

At high protection level all assets in the risky universe are examined for non-positive momentum, but the pace of the c(r)ash protection build up is quite vigorous: the allocation to the “safe” treasury asset equals the fraction of assets with non-positive momentum relative to half of the size of the risky universe. This is achieved by a protection factor of 2, so the denominator of the BF formula reads

½N.

To crystallize PAA’s c(r)ash protection routine, for each protection level the below table shows the fraction of capital allocated to the “safe” harbor treasury applied for a universe with 12 risky assets.

Dual universe supportCommonly in absolute momentum strategies a single “safety asset” like SHY, TLT or AGG is used for storm sheltering when the absolute momentum filter kicks in. However, a bet on long-term treasuries might prove itself hazardous when the proverbial tide goes out for global equities in a rising rate environment. On the other hand, the deployment of short-term treasuries might prohibit capturing capital gains on longer maturity T-Notes or T-Bonds as rates fall. Hence PAA supports multi treasury universes too, like the SHY/IEF combination, as the “safety asset” for mitigating yield risk while at the same time prospecting improved risk adjusted performance as well as attaining

absolute return performance (explained below). With multiple treasury funds to choose from, capital is allocated to the treasury asset with the highest relative momentum score irrespective of the sign.

BacktestsAs stated in our PAA paper the mechanics of the model are inspired by the work of both

Faber and

Antonacci. Hence our choice for an SMA (Faber) based momentum formula with a lookback of 12 months (Antonacci) that is used for calculating both absolute momentum (timing) as well as relative momentum (selection).

The PAA model will be backtested from Dec 1970 – Dec 2015 (45 years) on monthly total return data (see

paper for data construction). The universe of choice is a global diversified multi-asset universe consisting of proxies for 12 so called “risky” ETFs: SPY, QQQ, IWM (US equities: S&P500, Nasdaq100 and Russell2000 Small Cap), VGK, EWJ (Developed International Market equities: Europe and Japan), EEM (Emerging Market equities), IYR, GSG, GLD (Alternatives: REIT, Commodities, Gold), HYG, LQD and TLT (US High Yield bonds, US Investment Grade Corporate bonds and Long Term US Treasuries). The broadness of the universe makes it suitable for harvesting risk premia during different economical regimes.

NB!Results in this post are derived from synthetic data, do not reflect trading costs, slippage nor taxes and are purely hypothetical. The Disclaimer applies.GTAA* performanceFor the purpose of a reference point the concept of Meb Faber’s famous Global Tactical Asset Allocation model (GTAA) is used (see his 2013 updated

Quantitative Approach paper): allocate capital in equal portions to all assets or to the top selection of a universe that are above their long-term SMA and invest the remainder in a safe haven treasury fund like SHY with monthly portfolio reforms.

(*) For this replication – and different from Faber’s approach- our MOM(12) formula is deployed both for absolute and relative momentum (hence the term “Dual” in our paper). The performance metrics of our take on GTAA are summarized in the below table.

With Top=12 capital may be divided in equal portions over all assets in the universe provided each assets latest price resides above its long term SMA. As such with N=Top=12 capital allocation is only governed by timing. The capital fraction assigned to the safe harbor fund (here: SHY) is equal to the number of assets below their SMAs relative to the total number of assets in the universe.

With Top=6, 4, 3 next to timing (trend filtering) selection (relative strength) features too, assigning capital exclusively to the top performing “risky” assets, while top assets get capital assigned in equal portions, but only if they are above their long-term SMA, otherwise that portion of the portfolio is moved to a “safety asset” (here again: SHY).

The table demonstrates the effect of lower to higher concentrated portfolios: the high density Top=3 portfolios yields higher return R than the lowest density portfolio Top=12, but at the cost of higher volatility V, worse drawdown D and lower Sharpe SR (R/V) and MAR (R/D) ratios.

Absolute return performanceDespite the Top=12 scenario is getting really close, none of the GTAA scenarios attains

absolute return performance as defined in our paper: a 95% win rate of all rolling 1-year returns above 0% (R1yWin>0%) combined with a 99% win rate of all rolling 1-year returns above -5% (R1yWin>-5%). To clarify the metric: the rolling 1-year return reflects the cumulative portfolio return over a period of 12 months, where the observation “window” moves month-by-month as time passes. Since our data set contains monthly total return closing prices, our 45 year backtest period holds (45-1)x12+1=529 rolling 1-year observation points (44 instead of 45 because of the initial year). So to satisfy our

absolute return performance condition the rolling 1-year return must be above 0% for at least 95% of all 529 (=503) monthly observations while at the same time the rolling 1-year return needs to stay above the -5% watermark for a minimum of 99% of all a monthly observations, so for 524 or more months.

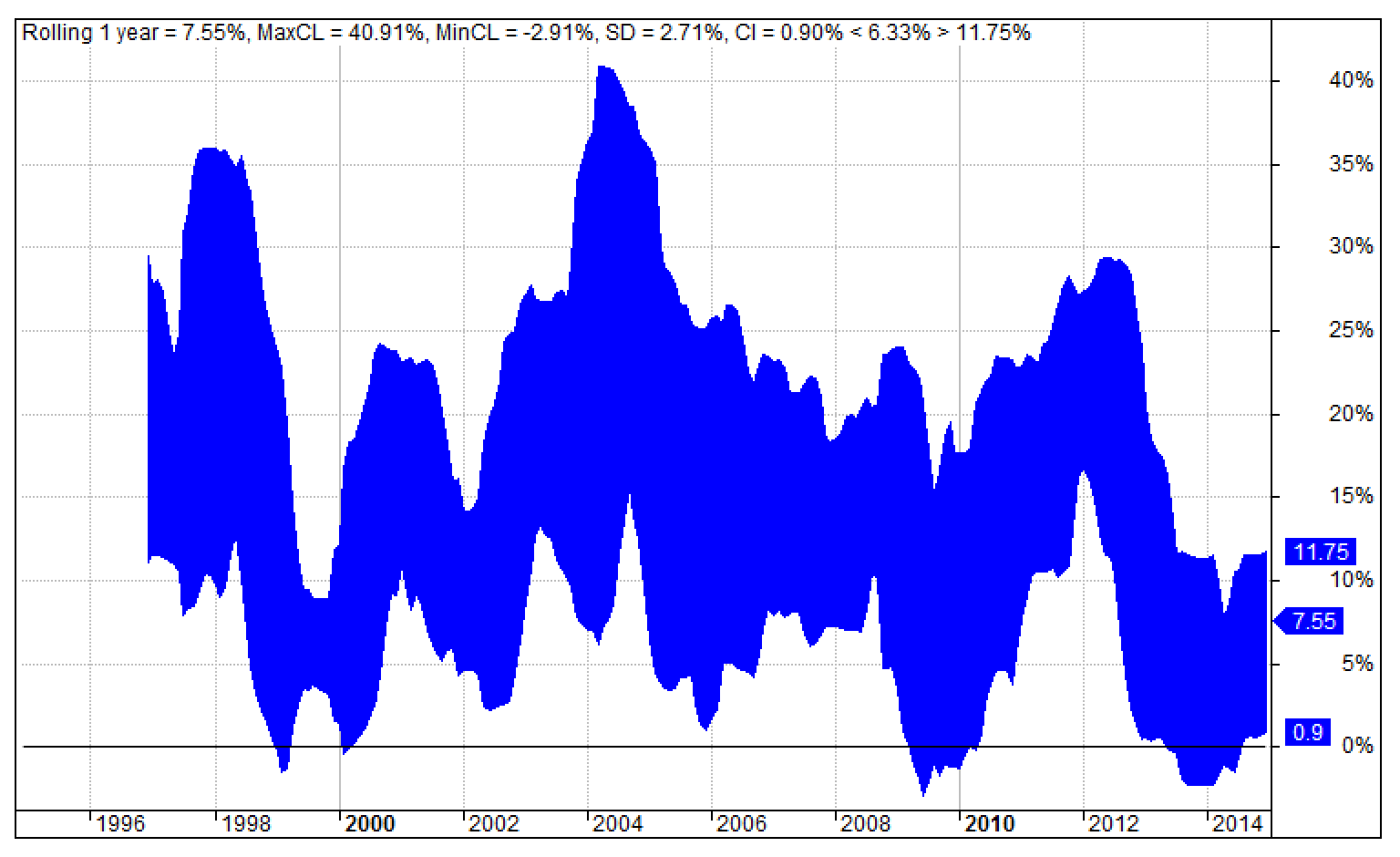

The below chart of the rolling 1-year return for the GTAA’s Top=3 scenario illustrates the application of the combined rolling 1-year-return requirement. The

absolute return performance levels are the horizontal lines at 0% (solid black) and -5% (dotted red) with the metrics denoted by the two R1yWin values on the right side of the chart’s title section. Note the required win rates are not satisfied for this scenario.

PAA performanceContrary to the GTAA safe harbor capital assignment, which is dependent on the number of Top assets not above their long-term SMAs, instead PAA with its multi-market breadth driven c(r)ash protection routine allocates capital to the safe harbor asset based on market-breadth for the full universe, so independently from the Top size (see again the capital fraction table earlier in this post).

The following table shows the impact of protective momentum for PAA with the protection level set to low (pf=0, denoted PAA0) for the same model scenarios GTAA was backtested for above.

Note that PAA0’s Top=12 scenario at low protection level is equal to GTAA with Top=12, so the reported results are equal. As stated, for the Top=6, 4, 3 scenarios the difference lies in the safe harbor capital allocation. While GTAA only checks timing for its top assets, PAA0 does so for its full universe. Albeit for every top scenario PAA0 realizes lower return R than GTAA (each roughly 1% lower), PAA0 reduces volatility V and drawdown D considerably. This holds true for risk adjusted return too (see SR and MAR). However, despite the improved risk adjusted returns, for none of the scenarios with PAA at low protection

absolute return performance is reached. The R1yWin rates falter just below the required 95% and 99% levels.

As the below table shows, when the protection level is increased to high (pf=2, denoted PAA2), PAA2 does attain

absolute return performance for three of the four scenarios (Win rates noted bold): Top=12, 6, 3 with scenario Top=4 barely missing its mark.

Compared to PAA0 risk adjusted performance is improved with PAA2, but once again at the cost of return R (0.8%-1.6%). With regard to optimal risk adjusted performance the Top=6 scenario looks appealing considering it achieves the highest MAR and R1yWin>-5% (tie) and second best Sharpe and R1yWin>0% readings.

“Crisis alpha”For the N12 universe at hand, with high protection enabled PAA invests on average over 50% in “cash” (see sub-pane of equity chart below). Although capital is well preserved with a short-term treasury asset like SHY, this also constitutes a drag on portfolio performance. However, swapping SHY for i.e. TLT introduces higher duration risk and goes along with more volatility and drawdown. Instead, the intermediate treasury fund IEF appears to be the trade-off as a replacement for cash. Still, the deployment of an alternating “safety asset” proved to be the best choice in risk adjusted terms. Thus PAA is less vulnerable to rate hikes, while at the same time the prospect to increase crisis alpha – higher risk adjusted performance during market crises - is not forfeited. With multiple safe harbors for sheltering on alert, capital is allocated to the treasury asset with the highest relative momentum score irrespective of the sign. For more on “crisis alpha” check Nathan Faber's winning NAAIM Wagner Award paper

The Search for Crisis Alpha: Weathering the Storm Using Relative Momentum.

The above table shows the performance break down of PAA2 with Top=6 sorted on R1yWin(>0%). Regarding

absolute return performance the SHY/IEF pair manages to combine the highest Win rates with near top R, second best SR plus MAR and third best V and D. Noteworthy is the impressive risk adjusted performance registered by both the single IEF and the single SHY scenarios too.

(*) For demonstration purposes three scenarios with TLT are listed too. Deployment of TLT as a storm shelter implies TLT features both in the “risk-on” universe as well as the “risk-off” universe. Notice the high drawdowns for each of these combinations along with elevated volatility levels, proving the point that TLT nor its combinations may regarded favorable for storm sheltering. Furthermore the return of IEF and its combinations is equally good or better along with lower volatility and left tail risk.

Comparison line upTo conclude this introduction of protective momentum first PAA2 with Top=6 is compared to three other strategies:

- EW (1/N for N12 equities universe, monthly rebalancing),

- SPY (buy and hold),

- 60/40 (SPY/IEF, monthly rebalancing).

The PAA2 results are for the N12 universe with SHY/IEF to pick as “safety asset”. Next some detailed charts for the PAA2 scenario at hand are presented.

The chart depicts (in semi-log scale) the equity curves of the four strategies in “wet paint” fashion to emphasize depth and duration of drawdowns. For PAA2 the chart’s subpane shows the capital allocation for the safety asset: SHY or IEF. The table holds the performance metrics of the four charted strategies.

PAA2 paints a smooth curve with shallow and constrained drawdown periods. Actually, time spend in drawdown is only 48.70% with a longest drawdown period of 19 months against SPY’s 68.52% and 74 months. Return is higher not only in risk adjusted terms, but also in absolute terms thanks to low volatility and drawdown readings. This demonstrates the key benefit of protective momentum: the low-risk profile keeps drawdowns in check during times of market turmoil.

Over recent years the performance of PAA2 lags the 60/40 benchmark as well as SPY. The lower return reflects the “insurance premium” due for PAA2’s market-breadth capital protection which typically leads to outperformance during bear markets and underperformance in prolonged bull.

Performance chartsTo conclude this introduction of PAA some detailed charts offer more perspective into PAA2’s performance with Top=6 selection.

Annual returns:

Profit contribution:

Capital allocation:

Drawdown:

Monthly return distribution:

Rolling 1-year-returns:

Rolling 1-year-return confidence channel:

“Real time” strategy signalsGoogle Sheets allows for monitoring the chosen PAA strategy after the close of the month. The Gsheet shows the one year history of the Top=6 selection, the number of assets with positive momentum, the bond fraction and the rolling 1-year performance. Below the historical table, the current selection is presented with their respective position sizes: see the two rows above the yellow warning box. The Gsheet is accessible through this blog's

Strategy Signals section.

![]() |

| Gsheet with PAA2 signals for April after the close of March, 2016. |

Point to note: only with a BF < 100% capital is allocated to the top selection, hence the positions sizes for the April 2016 Top=6 selection are 0.00%. All capital goes to the best safety asset: IEF.

Final remarksAs stated in our

paper, we consider the multi-market breadth approach for determining the safety asset’s capital fraction as the main innovation of Protective Asset Allocation. The routine as such may be regarded as a safety module which can be applied easily to general momentum models with volatility and/or correlation effects, like Keller’s EAA (see

paper and

primer).

Disclosure: long IEF.

The full AmiBroker code for PAA is available upon

request. Interested parties are encouraged to support this blog with a donation.